25+ Roth 401k calculator 2021

Total contributions to the plan for 2020 were 38500. Roth 401k 403b 457b indicates required.

Contribute To My 401k Or Invest In An After Tax Brokerage Account

This is the type of contribution that can be made as pre-taxtax-deferred or Roth deferral or a combination of both.

. Others imitate but as the 1 Solo 401k provider we innovate. He deferred 19500 in regular elective deferrals plus 6500 in catch-up contributions to the 401k plan. Money in a traditional 401k or IRA grows tax deferred meaning that you pay taxes on the money when you withdraw the funds and no taxes at all when you invest the money.

The 2021 deferral limit for 401k plans was 19500 the 2022. With a Roth IRA contributions are made from. Retirement Calculator Investment Calculator Net Worth Calculator Home Buying and Selling.

Also Roth 401k contributions can be made regardless of income level thereby affording taxpayers who would not otherwise be eligible to take advantage of the Roth component. Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears. For example if you have a 25 income tax rate and contribute 1000 to your retirement.

Salary Deferral Contribution In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can be contributed to a Solo 401k 2021 limits are 19500 and 26000 if age 50 or older. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Retirement Plans Menu Toggle.

If you want to roll over funds from a 401k into an IRA CD you must do so within 60 days. Setup Your Solo 401k Today. Retirement Savings Tips for 35-to-44-Year-Olds.

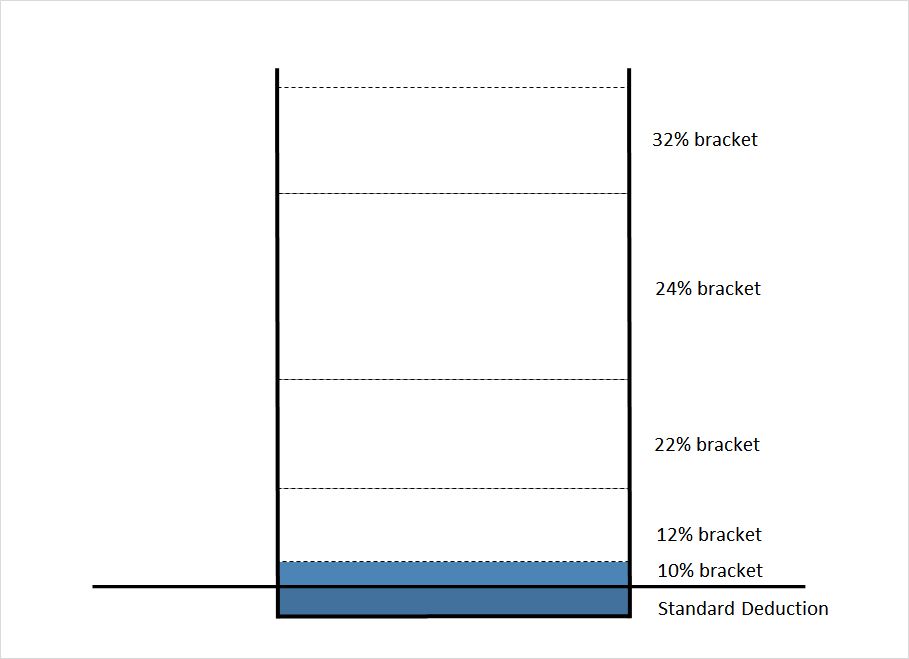

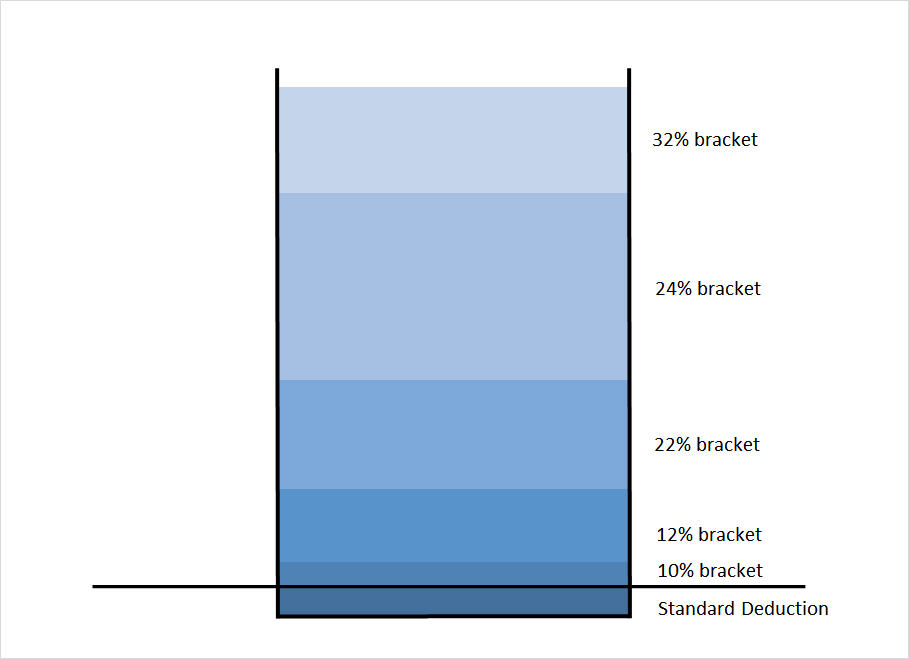

A qualified distribution from a Roth IRA meets all the requirements to be a tax-free withdrawal. Qualified distributions also include withdrawals at any age that go toward buying building or repairing your first home. For 2021 you can stay in the 12 tax bracket by keeping taxable income under 81050.

A Roth IRA and a 401k are two types of retirement accounts with one big difference in how they are taxed. Average 401k Returns Dont Tell the Whole Story. Mortgage Calculator Mortgage Payoff Calculator.

Snapshotted balance as of 972022. This is the maximum that can be contributed to the plan for Ben for 2019. The amount is increased to an adjusted gross income of 214000 up from 208000 in 2021.

Employers may make tax-deductible contributions of up to 25 of participant compensation as long as the combination of the employer contributions and the employee contributions does not exceed 100 of compensation or 58000 for 2021 or 64000 for those age 50 or older. Excludes any account value greater than 100000000 or less than -100000000. Average 401k Balance at Age 22-24 29251.

Additionally as the employer you can make a profit-sharing contribution up to 25 of your compensation from the business up to 58000 for tax year 2021 and the maximum 2022 solo 401k contribution is 61000. Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation. You could look at a Roth 401k.

The key difference between a Roth IRA and a traditional IRA has to do with how and when you are taxed. And the standard service tier charges a competitive annual fee of 025 of your assets under management. 61000 for 2022 or 67000 for those age 50 or older whichever is less.

Solo 401k Contribution Calculator. You can be a freelancer. How is a Roth IRA Different from a Traditional IRA.

This will help avoid paying monthly fees or early. The IRS contribution limit increases along with the general cost-of-living increase due to inflation. Excludes test and invalid accounts.

Accounts included are the following. However this number cant really tell you much. If you expect your salary to be 135000 or more in 2022 or was 130000 or more in 2021 you may need to contact your employer to see if these additional contribution limits apply to you.

For example someone withdrawing from a Roth IRA after reaching age 59½ is making a qualified distribution. Use this Solo 401k Contribution Comparison calculator to estimate the potential contribution that can be made to your Solo 401k plan by comparing it to Profit Sharing SIMPLE or SEP plans. In many ways the Solo 401k functions like a corporate 401k plan but allows you greater freedom to invest in what you want and contribute on your own schedule because you are your own 401k plan administrator and trustee.

The Solo 401k is a special type of retirement plan for business owners and their spouses. 401k former employer Roth 401k. Furthermore to qualify to make Roth IRA contributions filers must have earned income ie.

Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. Roth IRA Calculator. For 2021 and 2022 6000 per year 7000 per year for those age 50 or older.

His business contributed 25 of his compensation to the plan 12500. 15-Year Vs 30-Year Mortgage Calculator. For 2021 you can also contribute up to 58000 to your Solo 401k of which 19500 can be allocated as Roth contributions.

Vanguards 2022 How America Saves report says the average 401k balance for Vanguard participants in 2021 was 141542 up 10 from the 2020 level. Solo 401k plans also allow you to make post-tax Roth contributions. The maximum SEP IRA contribution is the lesser of 25 of adjusted net earnings or 58000 for 2021 61000 for 2022.

The Case Against Roth 401 K Still True After All These Years

The Benefits Of A Backdoor Roth Ira Financial Samurai

The Case Against Roth 401 K Still True After All These Years

New Jersey Secure Choice Faqs Fisher401k

Contribute To My 401k Or Invest In An After Tax Brokerage Account

Contribute To My 401k Or Invest In An After Tax Brokerage Account

The Benefits Of A Backdoor Roth Ira Financial Samurai

The Case Against Roth 401 K Still True After All These Years

401k To Roth Ira Conversion Rules Taxes Limits

Operating Cash Flow Formula Examples With Excel Template Calculator

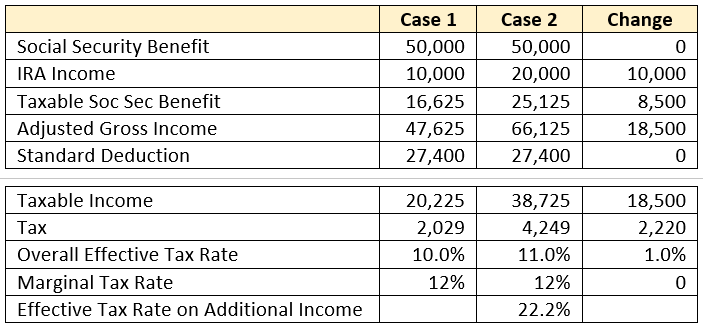

Social Security And Taxes Could There Be A Tax Torpedo In Your Future Apprise Wealth Management

How Much Should A 42 Year Old Invest In Roth Ira Monthly For How Long And Can I Open An Account For Kids 7 5 And 1 How Much And How Long Is There

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

The Benefits Of A Backdoor Roth Ira Financial Samurai

Sum Of Year Digits Method Of Depreciation How To Calculate With Example

Social Security And Taxes Could There Be A Tax Torpedo In Your Future Apprise Wealth Management

:max_bytes(150000):strip_icc()/GettyImages-955530312-5c254d0746e0fb000156da20.jpg)

401 K True Up Definition